حل الفوترة الإلكترونية في مصر

الامتثال مُبسّط مع BSC Global

في 5 خطوات فقط

اضمن الامتثال الكامل لمتطلبات مصلحة الضرائب المصرية (ETA) مع أتمتة عمليات الفوترة لديك من خلال التكامل السلس مع SAP.

مع دخول لوائح الفوترة الإلكترونية الإلزامية الصادرة عن الحكومة المصرية حيز التنفيذ:

❗ الفواتير الإلكترونية فقط هي الصالحة لاسترداد ضريبة القيمة المضافة والخصومات الضريبية.

📜 قد يؤدي عدم الامتثال إلى غرامات، ورفض مطالبات النفقات، والاستبعاد من المناقصات.

⚙️ يضمن التكامل السلس مع SAP عدم التدخل اليدوي وأقصى درجات الدقة.

Egypt E-Invoicing Solution

Compliance Simplified with BSC Global

In Just 5 Steps

Ensure full compliance with Egyptian Tax Authority (ETA) mandates while automating your invoicing processes with seamless SAP integration.

With the Egyptian government’s mandatory e-invoicing regulations now in force:

- ❗ Only electronic invoices are valid for VAT refunds and tax deductions.

- 📜 Non-compliance can lead to fines, rejection of expense claims, and exclusion from tenders.

- ⚙️ Seamless integration with SAP ensures zero manual intervention and maximum accuracy.

🚀 Why Choose BSC Global’s E-Invoicing Solution?

We deliver a comprehensive, all-in-one solution designed to help VAT-registered businesses comply with Egypt’s tax mandates. Our system addresses every aspect — from submission and validation to archiving and audit compliance.

Our solution is ideal for:

- Businesses already using SAP ECC, SAP S/4HANA, or SAP BTP

- Enterprises needing automated VAT processing and error-free compliance

- Companies seeking cost reduction and operational efficiency BSC GLOBAL –

Comprehensive Solutions offered

Designing Tomorrow with Innovative Solutions..

Innovation goes beyond being a mere trend; it’s the foundation of future success, a conviction held by more than 80% of business leaders.

💡 Core Features of BSC Global’s Solution

📊 Centralized Dashboard: Monitor all transactions from one SAP module.

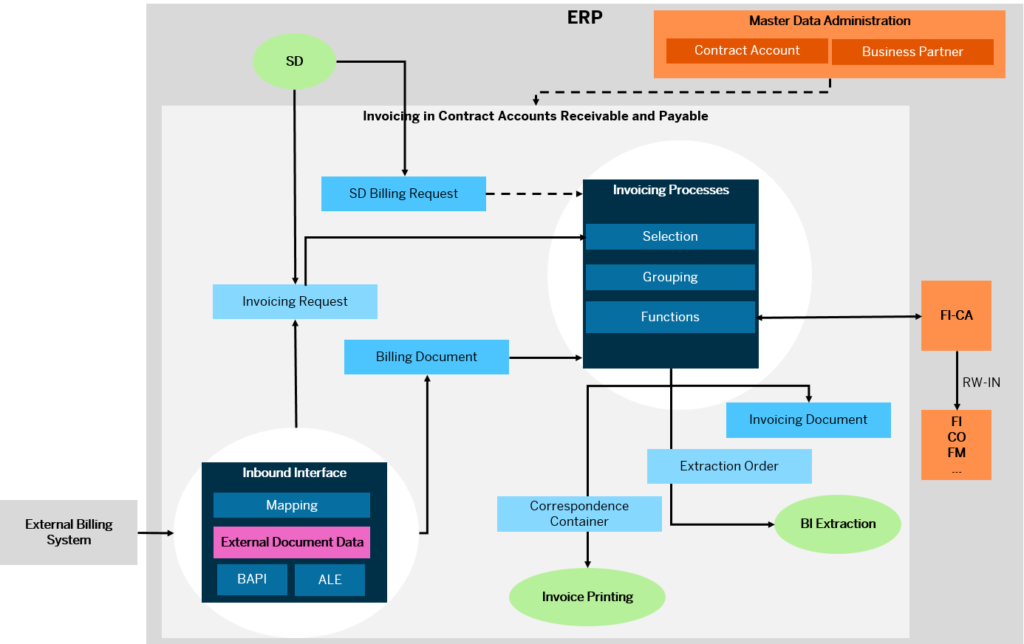

🔄 Automatic SAP Integration: Generates e-invoices automatically within your SAP environment.

⚡ Real-Time Validation: Validates documents instantly before submission.

🤖 Full Automation: UUID generation, e-signature, QR code creation & submission in one flow.

🧪 Error Pre-check: Prevents rejected invoices before they hit the ETA system.

🔐 Enterprise Security: Advanced encryption for data protection.

Driven by Client Success

“BSC Global’s Egypt E-Invoicing Solution ensured seamless compliance with ETA regulations while simplifying our invoicing operations. With smooth SAP integration and complete automation, generating and validating e-invoices became effortless, accurate, and fully compliant.”

🧩 Key Compliance Requirements

| Requirement | Details |

|---|---|

| Authority | Egyptian Tax Authority (ETA) |

| Mandatory | E-invoices for B2B and B2C transactions |

| Formats | JSON / XML |

| Signature | AES-certified digital signature (Mandatorily required) |

| Identification | 64-character ETA UUID |

| Archiving | Minimum 7 years |

| Registration | Mandatory digital certificate and ETA portal integration |

💡 Core Features of BSC Global’s Solution

- 🔄 Automatic SAP Integration: Generates e-invoices automatically within your SAP environment.

- ⚡ Real-Time Validation: Validates documents instantly before submission.

- 🤖 Full Automation: UUID generation, e-signature, QR code creation & submission in one flow.

- 🧪 Error Pre-check: Prevents rejected invoices before they hit the ETA system.

- 🔐 Enterprise Security: Advanced encryption for data protection.

- 📊 Centralized Dashboard: Monitor all transactions from one SAP module.

🛠️ Integration Setup — Fast & Hassle-Free

1️⃣ Registration – ETA system and digital certificate setup.

2️⃣ SAP Configuration – Development of connector and signature tools.

3️⃣ API Integration – REST-based submission setup.

4️⃣ QA Testing – Validate format, signature, and documentation.

5️⃣ Go-Live – 24×7 support for deployment and monitoring.

📈 Impact & Results

✅ Operational Excellence – 65M+ invoices processed across multiple countries.

✅ Cost Savings – Up to 70% savings from automation.

✅ Compliance Assurance – Always up-to-date with ETA requirements.

✅ Business Agility – Faster approvals and streamlined VAT processes.

🧾 Invoice Content Checklist

Every ETA-compliant invoice must include:

- Sequential invoice number, date & time

- Seller & buyer details with tax IDs

- Transaction description and tax details

- UUID and digital signature

- QR Code and GS1 product classification

📊 Why Global Brands Trust Us

Trusted by enterprises across Egypt, UAE, India, Malaysia, and Saudi Arabia, BSC Global boasts:

- 📈 Multi-country compliance expertise

- ⚙️ Tailored integration for SAP, Oracle, and Microsoft Dynamics

- 🤝 End-to-end support – from registration to ongoing compliance

- 🕐 24×7 assistance for continuous operations

🏆 Our Results at a Glance

| Metric | Result |

|---|---|

| Clients Served | 50+ |

| Invoices Processed | 65+ million |

| Processing Cost Reduction | 70% |

| Uptime | 100% |

📝 Get Started with BSC Global

Egypt’s e-invoicing isn’t just a compliance requirement — it’s a strategic advantage. Automate your invoicing, streamline VAT processes, and gain complete peace of mind.

RECOGNISED WORLD OVER SOLUTIONS

RECOGNISED WORLD OVER SOLUTIONS

Find out how BSC GLOBAL digitally transformed P2P cycle for worlds renowned brand in Automobile

Find out how BSC GLOBAL digitally transformed P2P cycle for worlds renowned brand in Automobile