iBank – Your Solution for Seamless SAP-Banking Integration

Future of Accounts Payable Automation

iBank seamlessly integrates banking systems with SAP, eliminating manual tasks and providing real-time updates for financial transactions.

Features.

HERE IS HOW SAP Banking Integration TOOL (Ibank) HELPS YOU.

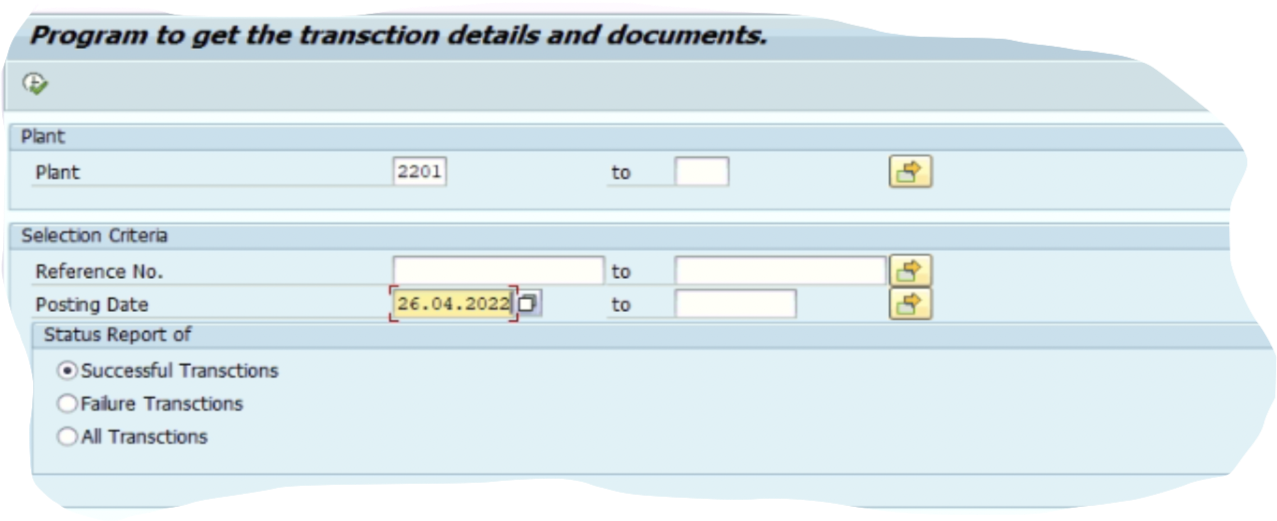

REAL TIME

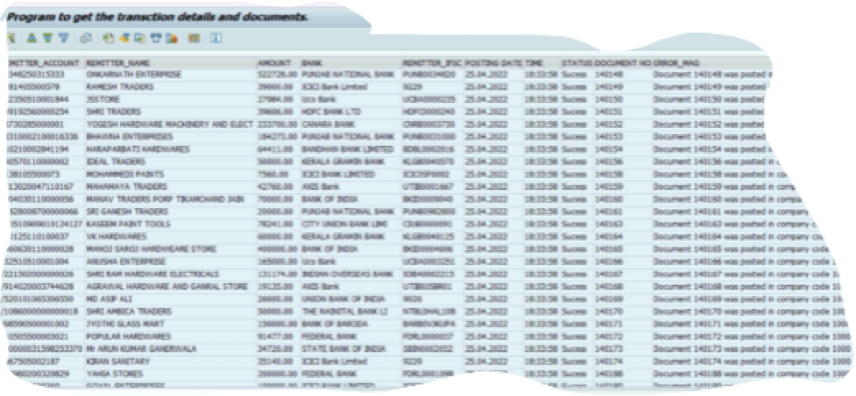

The moment any payment comes in bank it gets updated in SA

SECURE

Data is exchanged with secure approved Bank interface

END TO END

No need to have separate developments done in SAP. Documents are updated through ABAP Addon of this solution

NO MANUAL ACTION

There is no manual interference in terms changing or updating records anywhere

Why Banking Automation Solution.

whY are SAP Customers ADOPTING this Automation.

SAP-centric solution acts as an add-on to your SAP system. It also uses SAP technology such as ABAP and Workflow. It is also integrated with standard SAP functions till document posting. It also provides customers with process efficiency, visibility and compliance values. It optimises and simplifies the process of receiving, managing, monitoring and routing payment documentation on all levels.

Features.

Features of ibank for bank interface management

DIGITALIZE THE INTEGRATION OF SAP WITH YOUR BANK

Automation

iBank automates the integration between banking systems and SAP, significantly reducing the need for manual intervention. This streamlines financial processes, minimizes errors, and ensures that transactions are processed efficiently.

Security

Put an end to overpayments

Security is a paramount feature of iBank. It employs advanced encryption and authentication protocols to protect sensitive financial data, ensuring that transactions are secure and compliant with regulatory standards.

End-to-End Financial Document Update

Final posting till SAP

iBank offers a comprehensive solution that manages the entire process from transaction initiation to financial document update in SAP. This ensures that all financial data is accurately recorded and available in real-time for reporting and analysis.

One Single Cockpit

Custom Rules for Accounts Payable Automation

The solution provides a unified interface, or “single cockpit,” where users can monitor and manage all banking transactions within SAP. This centralized view enhances visibility and control, making it easier to track and manage financial activities.

Trace Duplication and Unsourced Payments

Gain real-time insights into your data.

iBank includes robust functionality to identify and trace duplicate transactions and unsourced payments. This helps in maintaining data integrity and ensuring that all financial records are accurate and accounted for, reducing discrepancies and improving financial accuracy.

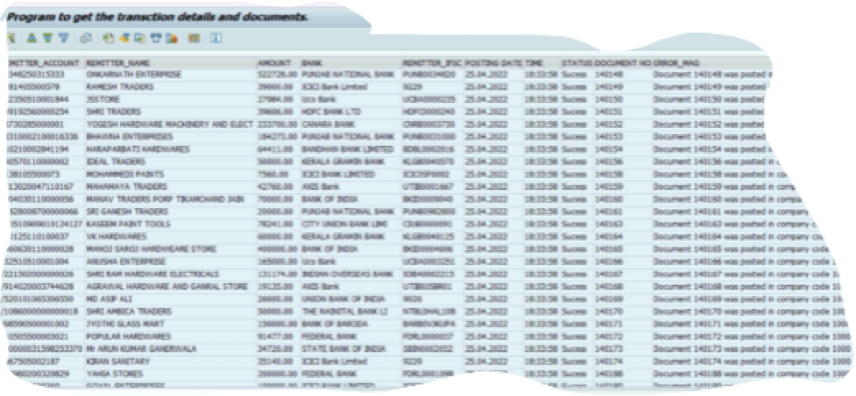

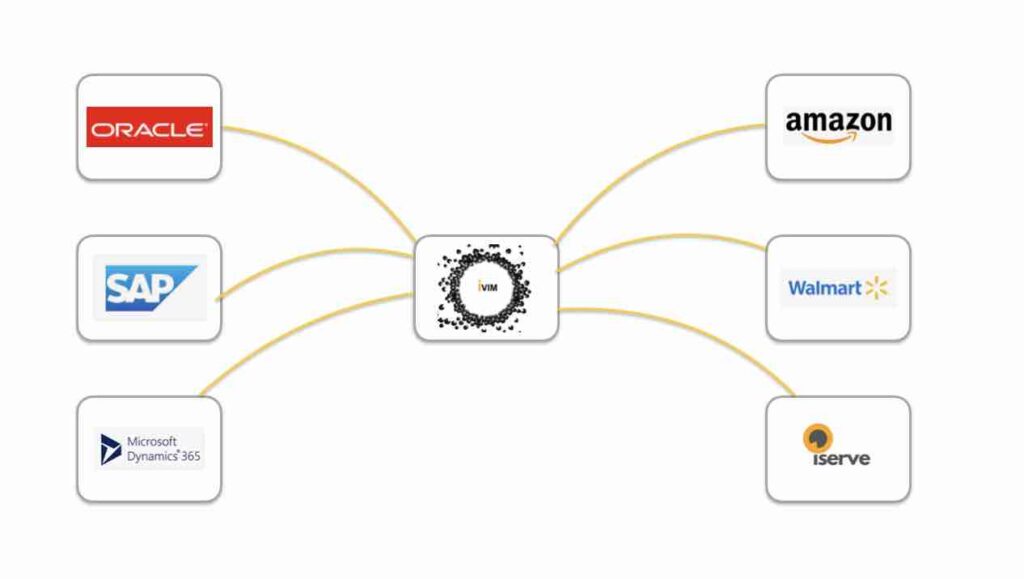

Easy INtegration.

integration Easy , Connector.

Ivim has connector for SAP and various other ERP’s

Do You have a Question for iBank

Our experts are around to help you any time.

SAP and Banking Integration Software FAQS- FREQUENTLY ASKED QUESTIONS

What is SAP banking integration, and why is it important for businesses?

SAP banking integration automates financial transactions and processes, increasing efficiency, providing real-time data, cost savings, ensuring compliance with regulations, and enhancing security. It reduces manual efforts, improves visibility, and ensures compliance with banking standards, thereby protecting sensitive financial data.

What are the benefits of automating banking integration with SAP?

SAP’s banking integration streamlines processes, improves accuracy, enhances cash flow management, saves time for finance teams, and improves reporting, allowing for better compliance and auditing processes, while reducing manual data entry and errors.

How does SAP banking integration work?

SAP banking integration connects your SAP system to your bank’s through secure electronic data interchange (EDI). It automates data exchange, payment processing, bank reconciliation, and ensures compliance with industry standards by using secure communication channels to protect financial data.

Which businesses benefit the most from SAP banking integration?

SAP banking integration is beneficial for businesses with high transaction volumes, multinational operations, complex financial processes, highly regulated industries, and growth-oriented businesses. It streamlines global financial operations, ensures compliance with regulations, and helps manage increased transaction volumes and complexity effectively.

RECOGNISED WORLD OVER SOLUTIONS

RECOGNISED WORLD OVER SOLUTIONS

Find out how BSC GLOBAL digitally transformed P2P cycle for worlds renowned brand in Automobile

Find out how BSC GLOBAL digitally transformed P2P cycle for worlds renowned brand in Automobile