Empowering Growth, Simplifying Compliance – Your GST Partner for better Tomorrow.

Future of GST Automation

BSC Global is a GSP ASP in india with experties of GST bsc global is simplifying GST operations for Enterprises

Numbers and Solutions Which Talk about our GST expertise.

Simplifying GST Operations

65+

Million invoices processed

50+

Clients using our Services in GST

2000

Crore valued invoices processed

HERE IS HOW GST Services and Solutions are helping our clients.

REAL TIME

IRN and EWAY Update in real time in SAP and other ERP’s

SECURE

Data is exchanged with secure systems

END TO END

No need to have separate developments done in SAP. We have connector and update in SAP as part of our solutions

NO MANUAL ACTION

There is no manual interference in terms changing or updating records anywhere

HEAD IT “BSC Global’s GST solutions is not only matching compliance measures but also enhanced overall operational efficiency , reconciliation and transparency in tax management.“

Features.

Features of Bgst for All GST Needs

GST e invoicing System or electronic invoicing is a process of validating invoices electronically thru GST Network (GSTN) for further use on common GST portal.

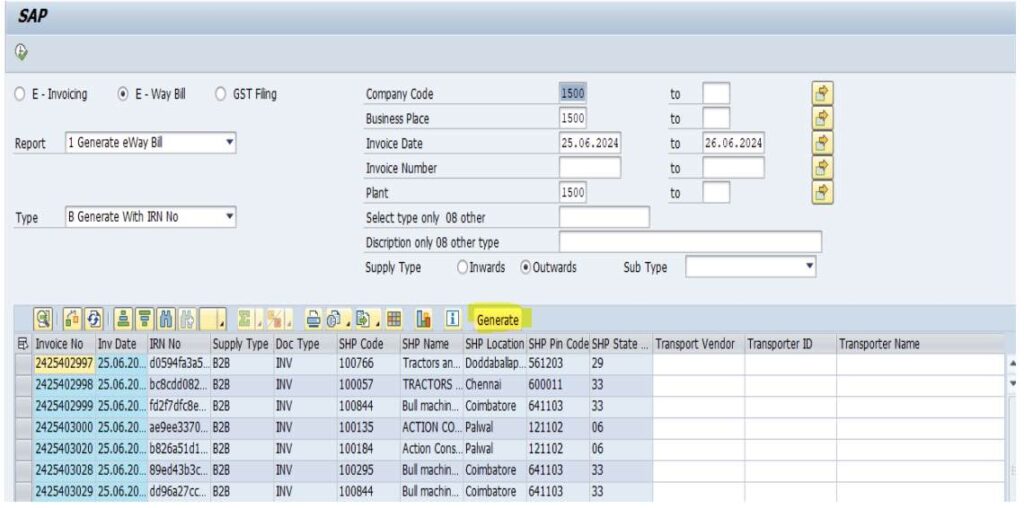

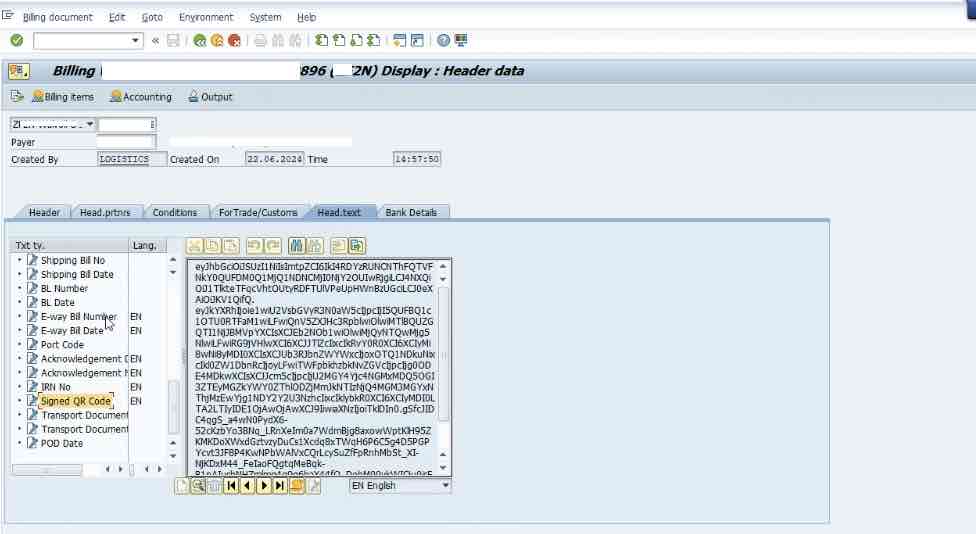

BGST a simple solution by BSC Global has been built with an focus to simplify SAP and other ERP ‘s , BSC Global has built GST e Invoicing system to simplify the adoption of Legal GST compliance and fully automate the response from GST IRP and updation of BARCODE and QR Code Response back in SAP system .

E-Invoice and E-Way Billing GST

Automation

BGST a simple solution by BSC Global has been built with an focus to simplify SAP and other ERP ‘s , BSC Global has built GST e Invoicing system to simplify the adoption of Legal GST compliance and fully automate the response from GST IRP and updation of BARCODE and QR Code Response back in SAP system . .

DIGITALIZE THE INTEGRATION OF SAP WITH YOUR GST

Automation

SAP Connector for GST to ensure end to end implementation of GST for SAP Customer. SAP update till document level , one cockpit for all your needs to check the status of GST , EWAY and Einvoice fillings. GSTR-1, 2 and others.

Security

Put an end to overpayments

Security is a paramount feature of BGST. It employs advanced encryption and authentication protocols to protect sensitive financial data, ensuring that transactions are secure and compliant with regulatory standards.

End-to-End Financial Document Update

Final posting till SAP

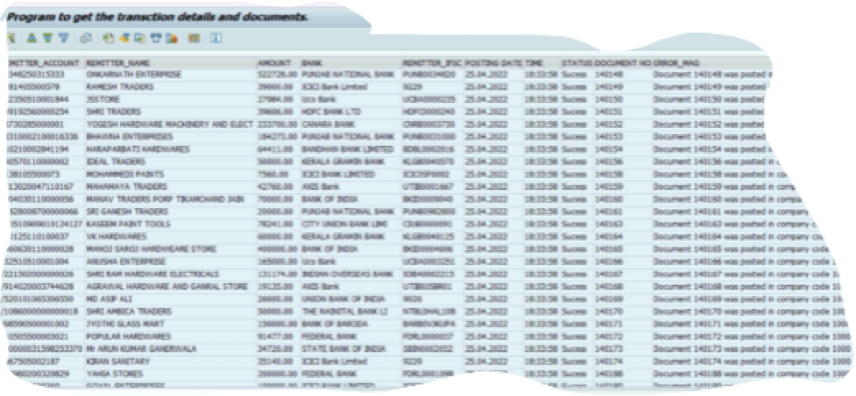

GST offers a comprehensive solution that manages the entire process from transaction initiation to financial document update in SAP. This ensures that all master data and transaction data is accurately recorded and available in real-time for legal reporting and analysis.

One Single Cockpit

Custom Rules for Accounts Payable Automation

The solution provides a unified interface, or “single cockpit,” where users can monitor and manage all GST transactions and logs within SAP. This centralized view enhances visibility and control, making it easier to track and manage financial activities.

Error Logs and Pre-Checks for GST Submission

Gain real-time insights into your data.

B GST includes robust functionality to identify and trace error in transactions and unsourced transaction. This helps in maintaining data integrity and ensuring that all records are accurate and accounted for, reducing discrepancies and improving financial accuracy.

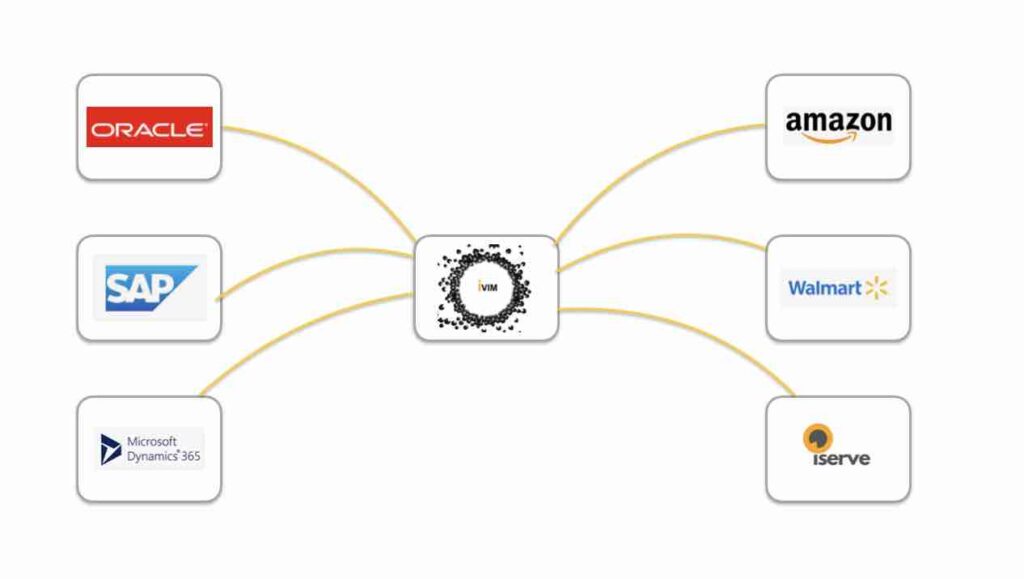

Easy INtegration.

integration Easy , Connector.

BGst has connector for SAP and various other ERP’s

White PaPER.

Expertise for Value

creation.

GST Reconciliation

Various forms and returns that businesses must file under GST, GSTR-3B and GSTR-3A are pivotal

GSTR 3A

Accurate GST reconciliation helps avoid discrepancies, ensures compliance, and optimizes the claiming of Input Tax Credit (ITC)

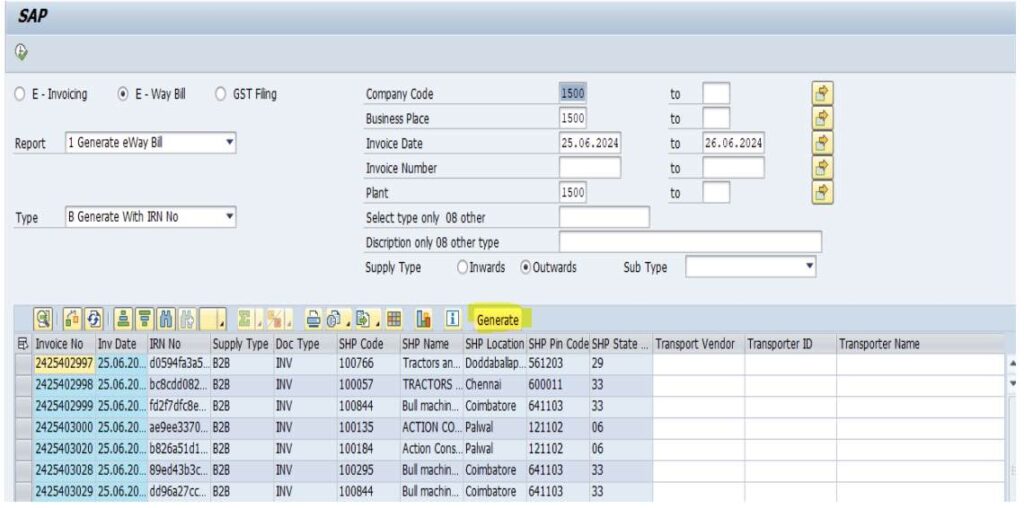

E-Way Billing

E-Way Bill system, which is crucial for the seamless transportation of goods. SAP, a leading enterprise resource planning (ERP) software, offers robust solutions to integrate E-Way Bill compliance into business processes. This short blog explores how E-Way Billing works in SAP and its benefits for businesses

Reconciliation

Reconcile various GSTR’s to find the missing reports

Analytics

Enhancing Warehouse Efficiency with Pick By Voice in SAP EWM

Validate

Step by Step Approach to validate MSME , GST , PAN , EWAY Status

GST E invoicing and E Way Billing FAQs- Frequently Asked Questions

What is GST e-invoicing, and why is it important for businesses in India?

GST e-invoicing is an Indian government system that ensures B2B invoices are authenticated by the GST Network (GSTN), reducing errors and penalties. It automates the invoice generation process, ensures data accuracy, streamlines tax reporting, and prevents invoice fraud by ensuring every invoice is authenticated.

What are the key features of GST e-invoicing software?

GST e-invoicing software generates Invoice Reference Numbers (IRNs), ensures compliance with GSTN records, integrates seamlessly with ERP or accounting software, supports bulk processing, generates QR codes, and provides a complete audit trail for transparency and easy tracking.

How does GST e-invoicing benefit businesses in India?

GST e-invoicing simplifies compliance, automates invoice generation, reduces costs, and improves accuracy. It automates reconciliation, reduces fraud risk, and streamlines cash flow management. It also reduces manual intervention, ensuring all invoices are authenticated. This benefits businesses by reducing penalties and operational costs.

Who is required to use GST e-invoicing in India?

GST e-invoicing is mandatory for businesses with turnover over ₹10 Crore, registered taxpayers, and certain exemptions. The threshold may be lowered in the future, so businesses should stay updated on the latest regulations.

Join Our GST Network of more than 50 Happy Customers

Do You nEED A QUOTE for GST

Get QUote Now

GST Returns Analytics and IRN

GST Returns Analytics and IRN

RECOGNISED WORLD OVER SOLUTIONS

RECOGNISED WORLD OVER SOLUTIONS

Find out how BSC GLOBAL digitally transformed P2P cycle for worlds renowned brand in Automobile

Find out how BSC GLOBAL digitally transformed P2P cycle for worlds renowned brand in Automobile