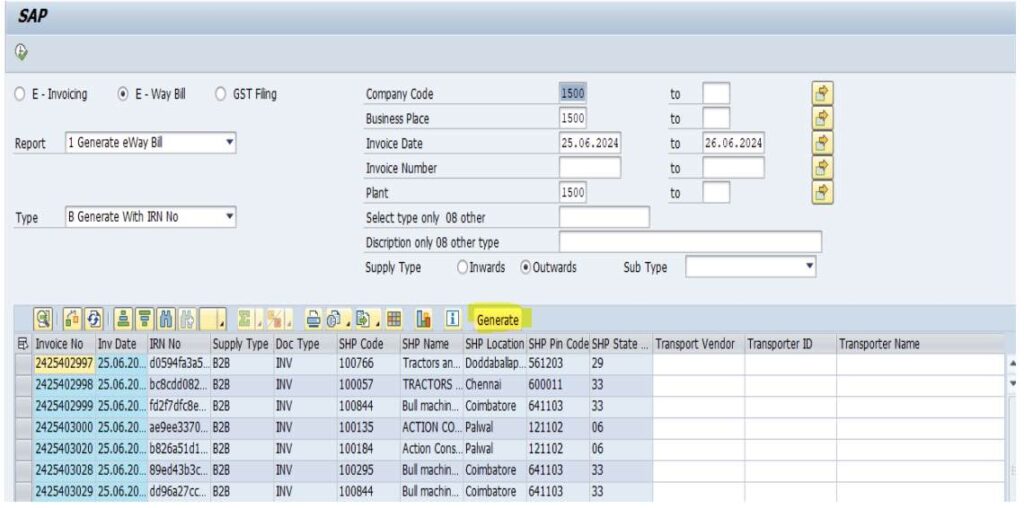

Simplifying GST Validation in SAP- AUTOMATION .

Future of GST Automation

BSC Global is a GSP ASP in India with expertise of GST. BSC global is simplifying GST Validation operations for Enterprises within SAP so there is no need to login external system

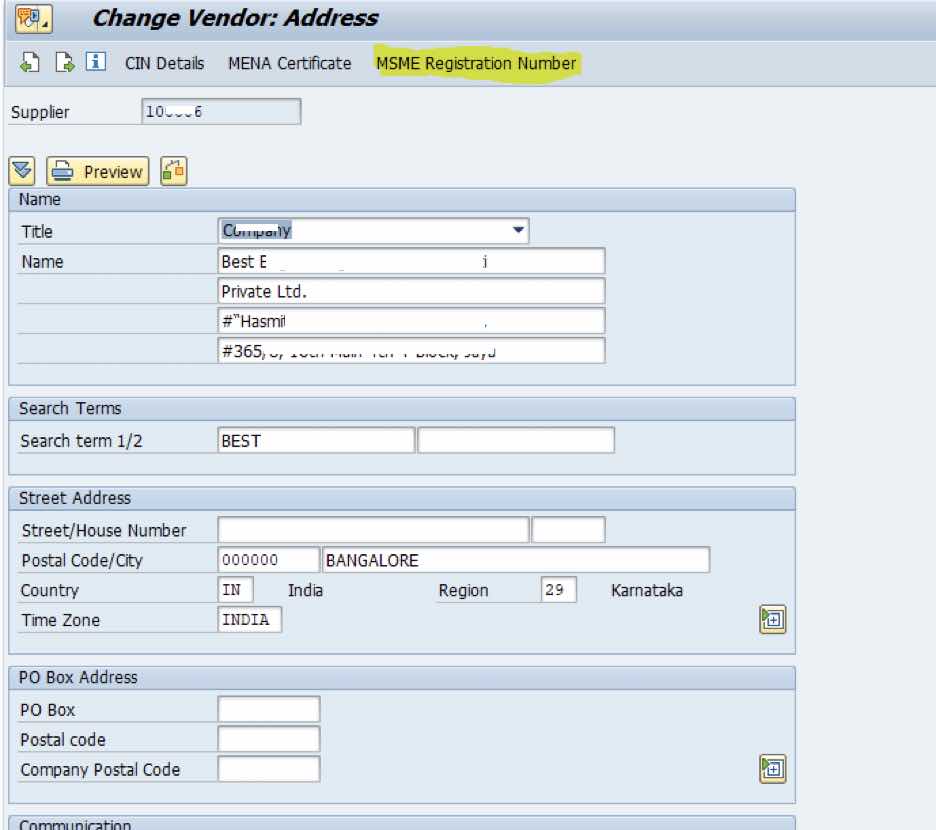

BSC Global’s solution to automatically update vendor GST status in SAP likely involves leveraging integration capabilities and possibly third-party tools or custom developments. Here’s a conceptual outline of how such a solution could be implemented:

5 Steps to get Automatically Vendor GST Status updated in SAP by BSC GLOBAL’s BGST Solution

- Integration Setup:

- Connectivity: Establish connectivity between SAP and BGST

- Automation Logic copied in SAP:

- Implement logic within SAP which is build by BSC GLOBAL to trigger automatic updates based on predefined events or schedules (e.g., vendor master data change, periodic checks)..

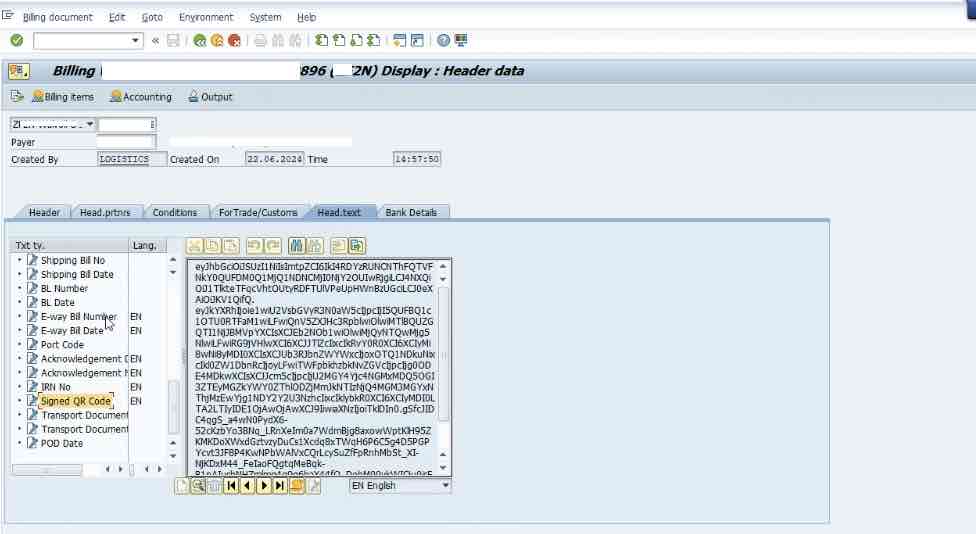

- Validation Process:

- Our SAP Solution initiates API calls to the GST portal to validate GSTINs.

- Handle responses from the GST portal (e.g., active, inactive, cancelled) and update SAP records accordingly.

- Error Handling and Logging:

- It can handle errors gracefully, such as timeouts, API failures, or invalid responses from the GST portal.

- Log activities and updates for audit purposes, ensuring transparency and traceability of changes.

- User Notifications:

- Optionally, we provide notifications within SAP to alert relevant users or teams about changes in GST status or validation errors.

Considerations:

- Security: Ensure secure transmission of data between SAP and external systems, adhering to data protection regulations.

- Compliance: Stay updated with changes in GST regulations and adjust the solution as necessary to comply with new requirements.

- Scalability: Design the solution to handle a large volume of vendor records efficiently, considering performance and scalability.

Implementing such a solution streamlines compliance efforts, reduces manual effort, and ensures accuracy in vendor data management within SAP, aligning with regulatory requirements regarding GST validation.

RECOGNISED WORLD OVER SOLUTIONS

RECOGNISED WORLD OVER SOLUTIONS

Find out how BSC GLOBAL digitally transformed P2P cycle for worlds renowned brand in Automobile

Find out how BSC GLOBAL digitally transformed P2P cycle for worlds renowned brand in Automobile