BSC UAE E-Invoicing Services

Stay Ahead of E-Invoicing Mandates for UAE.

Ensure your business is compliant with the latest regulations while improving operational efficiency through SAP integration.

GLOBAL Experience in E-invoicing in SAP

Simplifying E-invoicing Operations across globe

In today’s fast-evolving regulatory landscape, e-invoicing compliance is critical for businesses operating across multiple geographies. At BSC Global, we offer comprehensive e-invoicing services tailored to meet the unique regulations of countries like India, Egypt, Malaysia, UAE, and more.

65+

Million invoices processed

50+

Clients using our Services in Einvoicing

30+

add ons for Einvoicing

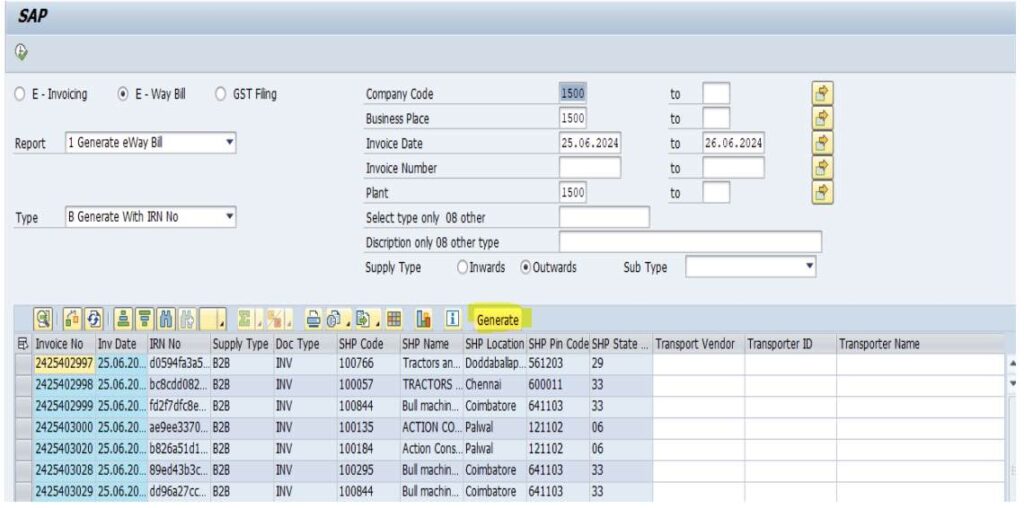

Only 5 Steps in SAP

Within SAP E-Invoicing and that too in just 5 Steps

Automated E-Invoice Generation

Instantly create compliant electronic invoices that meet UAE Ministry of Finance specifications in XML and JSON formats.

Digital Signatures & Security

Industry-leading encryption and digital signature integration for tamper-proof, legally binding e-invoices.

Real-Time ASP Integration

Seamless connection to Authorized Service Providers (ASPs) for secure transmission through the Peppol network.

Complete Audit Trail

Maintain 5-year archiving and full transaction history for compliance reporting and tax authority audits.

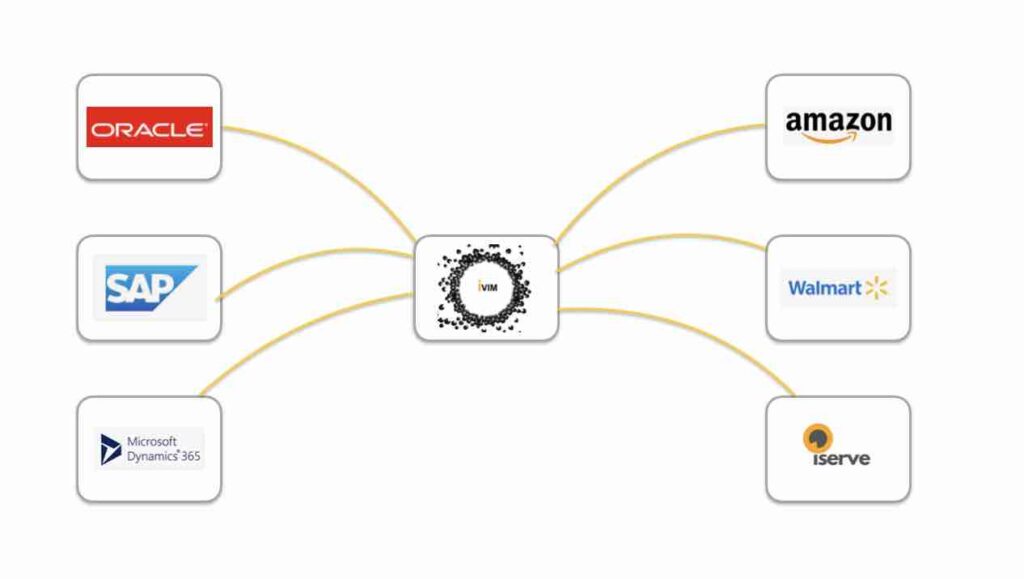

ERP Integration

Direct integration with SAP, Oracle, and other enterprise systems for automated invoice workflows.

Mobile-Friendly Dashboard

Features.

Features of Bgst for All Einvoicing Needs

e invoicing System or electronic invoicing is a process of validating invoices electronically through government taxation portal

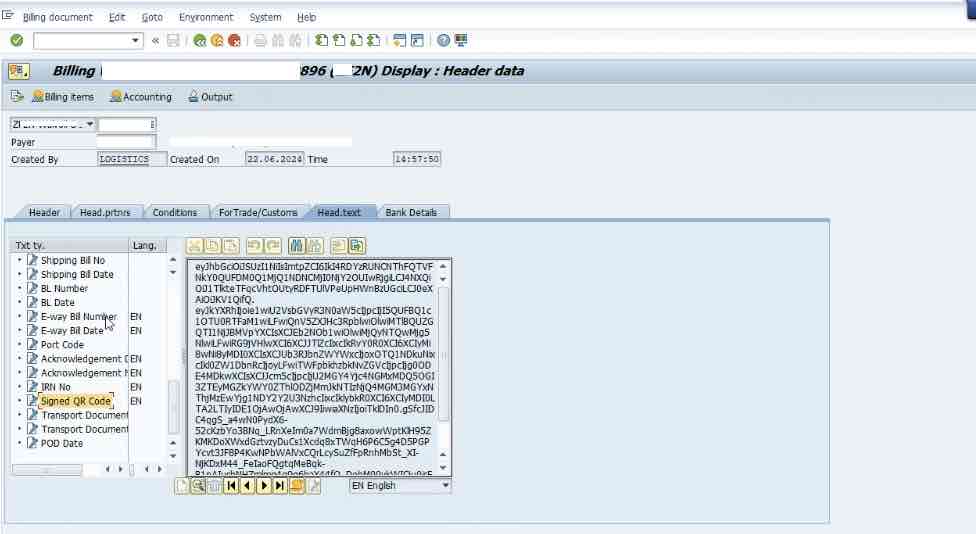

BGST a simple solution by BSC Global has been built with an focus to simplify SAP and other ERP ‘s , BSC Global has built e Invoicing system to simplify the adoption of Legal E-invoicing compliance and fully automate the response from portals updation of BARCODE and QR Code Response back in SAP system .

E-Invoice

Automation

BGST a simple solution by BSC Global has been built with an focus to simplify SAP and other ERP ‘s , BSC Global has built e Invoicing system to simplify the adoption of Legal compliance and fully automate the response from tax authority and updation of BARCODE and QR Code Response back in SAP system . .

DIGITALIZE THE INTEGRATION OF SAP WITH YOUR Einvoice

Automation

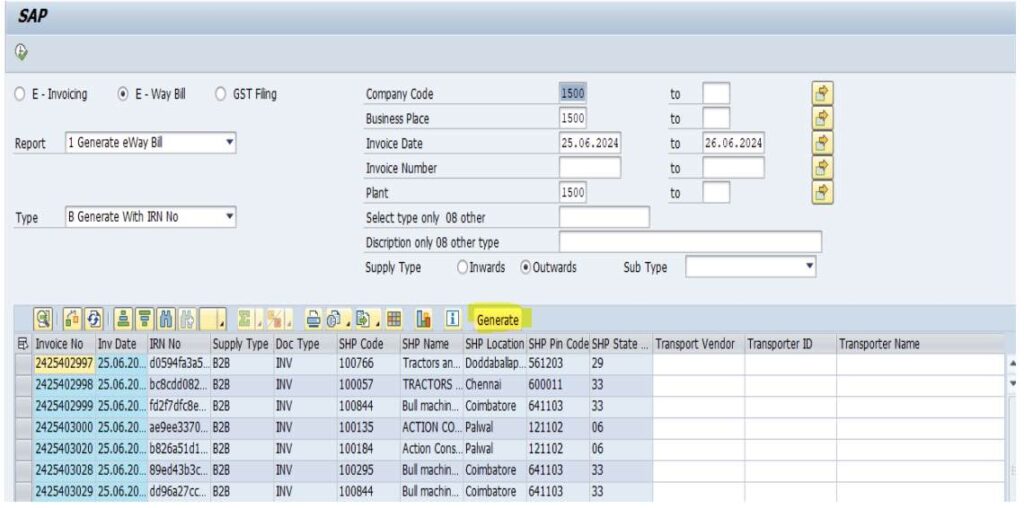

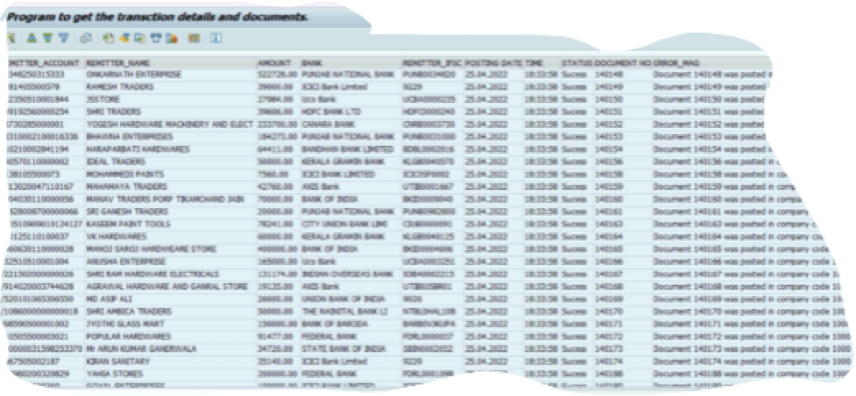

SAP Connector for E-invoicing to ensure end to end implementation of E-invoicing for SAP Customer. SAP update till document level , one cockpit for all your needs to check the status of E-invoicing, EWAY and Einvoice fillings. GSTR-1, 2 and others.

Security

Put an end to overpayments

Security is a paramount feature of BGST. It employs advanced encryption and authentication protocols to protect sensitive financial data, ensuring that transactions are secure and compliant with regulatory standards.

End-to-End Financial Document Update

Final posting till SAP

E-invoicing offers a comprehensive solution that manages the entire process from transaction initiation to financial document update in SAP. This ensures that all master data and transaction data is accurately recorded and available in real-time for legal reporting and analysis.

One Single Cockpit

Custom Rules for Accounts Payable Automation

The solution provides a unified interface, or “single cockpit,” where users can monitor and manage all E-invoicing transactions and logs within SAP. This centralized view enhances visibility and control, making it easier to track and manage financial activities.

Error Logs and Pre-Checks for Submission

Gain real-time insights into your data.

B GST includes robust functionality to identify and trace error in transactions and unsourced transaction. This helps in maintaining data integrity and ensuring that all records are accurate and accounted for, reducing discrepancies and improving financial accuracy.

UAE E-Invoicing Implementation Timeline

Now – Jul 2026

Preparation & ASP Setup

Businesses prepare systems, select Authorized Service Providers, and conduct integration testing with FTA sandbox environment.

Jul 1, 2026

Pilot Program Launch

Voluntary participation begins with selected taxpayers. BSC Global ensures your systems are ready for live transactions.

Easy INtegration with SAP.

integration Easy , Connector.

BGst has connector for SAP and various other ERP’s

Compliance.

UAE E-INVOICING COMPLIANCE.

Full alignment with Ministerial Decisions 243 & 244 of 2025

✓ Regulatory Requirements Met

- Compliant with Federal Decree-Law No. 16 of 2024

- XML & JSON format support as per FTA specifications

- Digital signature implementation

- Peppol 5-corner model architecture

- Mandatory transaction reporting from day one

- 5-year electronic archiving and storage in UAE

✓ Phased Implementation Support

- Phase 1 (Jan 2027): Large businesses (Revenue ≥ AED 50M)

- Phase 2 (Jul 2027): Medium businesses (Revenue < AED 50M)

- Phase 3 (Oct 2027): UAE Government entities

- Pilot program support from Jul 1, 2026

- Sandbox testing environment for integration

✓ Business Requirements Covered

VAT calculation & reporting

B2B & B2G transaction handling

Invoice issuance within 14 days of taxable event

Self-billing for registered taxpayers

Credit note generation & management

Multi-currency support

TIMELINE.

UAE E-Invoicing Implementation Timeline

Full alignment with Ministerial Decisions 243 & 244 of 2025

Jan 1, 2027

Phase 1: Large Business Mandate

E-invoicing becomes mandatory for businesses with annual revenue ≥ AED 50 million. ASP appointment deadline: Jul 31, 2026.

Jul 1, 2027

Phase 2: Medium Business Mandate

E-invoicing mandatory for businesses with revenue < AED 50 million. Deadline for compliance: Mar 31, 2027.

Oct 1, 2027

Phase 3: Government Entities

All UAE Government entities transition to mandatory e-invoicing. Deadline for preparation: Mar 31, 2027.

White PaPER.

Expertise for Value

creation.

GST Reconciliation

Various forms and returns that businesses must file under GST, GSTR-3B and GSTR-3A are pivotal

GSTR 3A

Accurate GST reconciliation helps avoid discrepancies, ensures compliance, and optimizes the claiming of Input Tax Credit (ITC)

E-Way Billing

E-Way Bill system, which is crucial for the seamless transportation of goods. SAP, a leading enterprise resource planning (ERP) software, offers robust solutions to integrate E-Way Bill compliance into business processes. This short blog explores how E-Way Billing works in SAP and its benefits for businesses

Reconciliation

Reconcile various GSTR’s to find the missing reports

Analytics

Enhancing Warehouse Efficiency with Pick By Voice in SAP EWM

Validate

Step by Step Approach to validate MSME , GST , PAN , EWAY Status

E invoicing UAE FAQs- Frequently Asked Questions

What is e-invoicing, and why is it important for businesses?

e-invoicing is an taxation system that ensures B2B invoices are authenticated by the government tax network, reducing errors and penalties. It automates the invoice generation process, ensures data accuracy, streamlines tax reporting, and prevents invoice fraud by ensuring every invoice is authenticated.

What are the key features of UAE e-invoicing software?

e-invoicing software generates Invoice Reference Numbers (IRNs), ensures compliance with government records, integrates seamlessly with ERP or accounting software, supports bulk processing, generates QR codes, and provides a complete audit trail for transparency and easy tracking.

How does e-invoicing benefit businesses in UAE?

GST e-invoicing simplifies compliance, automates invoice generation, reduces costs, and improves accuracy. It automates reconciliation, reduces fraud risk, and streamlines cash flow management. It also reduces manual intervention, ensuring all invoices are authenticated. This benefits businesses by reducing penalties and operational costs.

Who is required to use e-invoicing in UAE?

GST e-invoicing is mandatory for businesses with turnover over ₹10 Crore, registered taxpayers, and certain exemptions. The threshold may be lowered in the future, so businesses should stay updated on the latest regulations.

Join Our GST Network of more than 50 Happy Customers

RECOGNISED WORLD OVER SOLUTIONS

RECOGNISED WORLD OVER SOLUTIONS

Find out how BSC GLOBAL digitally transformed P2P cycle for worlds renowned brand in Automobile

Find out how BSC GLOBAL digitally transformed P2P cycle for worlds renowned brand in Automobile